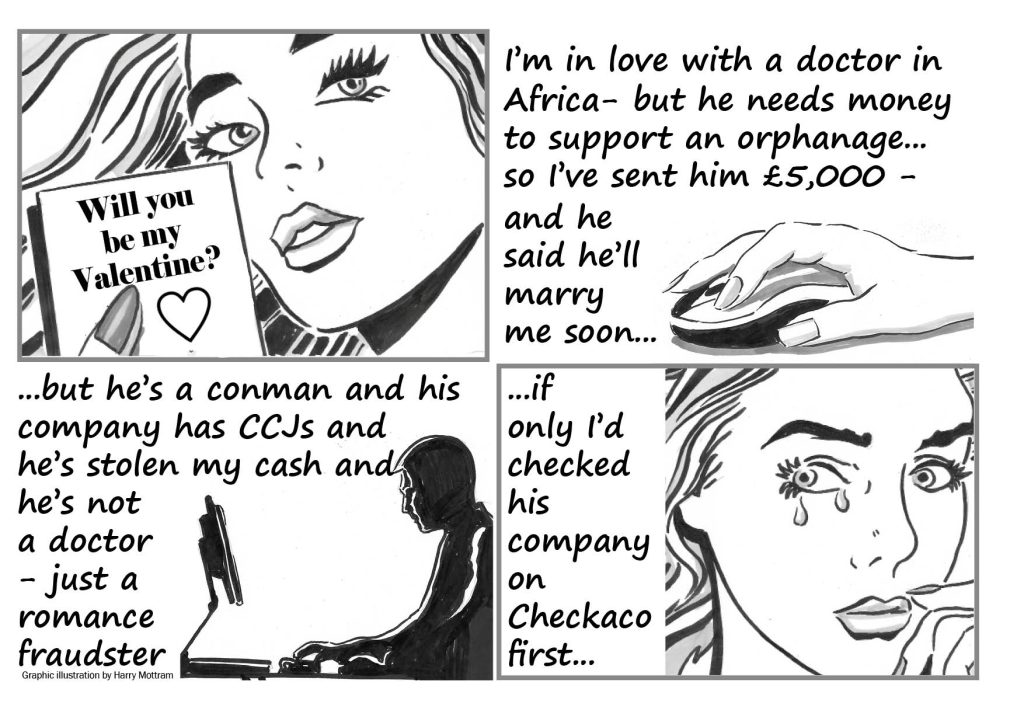

Checkaco Consumer News: romance fraud is fleecing victims of thousands of pounds every week – don’t be conned this Valentine’s

Posted on by Harry Mottram Edit”Checkaco Consumer News: romance is fleecing victims of thousands of pounds every week – do be conned this Valentine’s”

By Harry Mottram: years ago romance bloomed in discos, the pub or even the bus stop – but today couples get hitched online. And that can spell danger as fraudsters can pose on sites like Tinder as someone they are not by using other people’s photos and information. Once they have hooked someone as a potential partner the sob stories begin in which a familiar story of being temporarily short of cash.

Crimestoppers say: “Many fraudsters claim to be overseas because they work in the military or medical profession. They make up excuses as to why they can’t video chat or meet in person, and will try to move your conversations off the platform you met on. When they ask for financial help, it’ll be for a time-critical emergency, and the reason will be something that pulls at the heartstrings.”

Another form of romance fraud is where the fraudster has a company that needs cash for a humanitarian or charity enterprise – but has a temporary issue with a bank account that can’t release any money. Using Checkaco you can check out how if the company is genuine and if it has a long history of financial problems such as County Court Judgements (CCJc) or winding up orders.

Remember with St Valentine’s day approaching dating websites may have attractive looking men and women posing as potential lovers. Stop, think and protect by never sending cash.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

++++++++++++++++

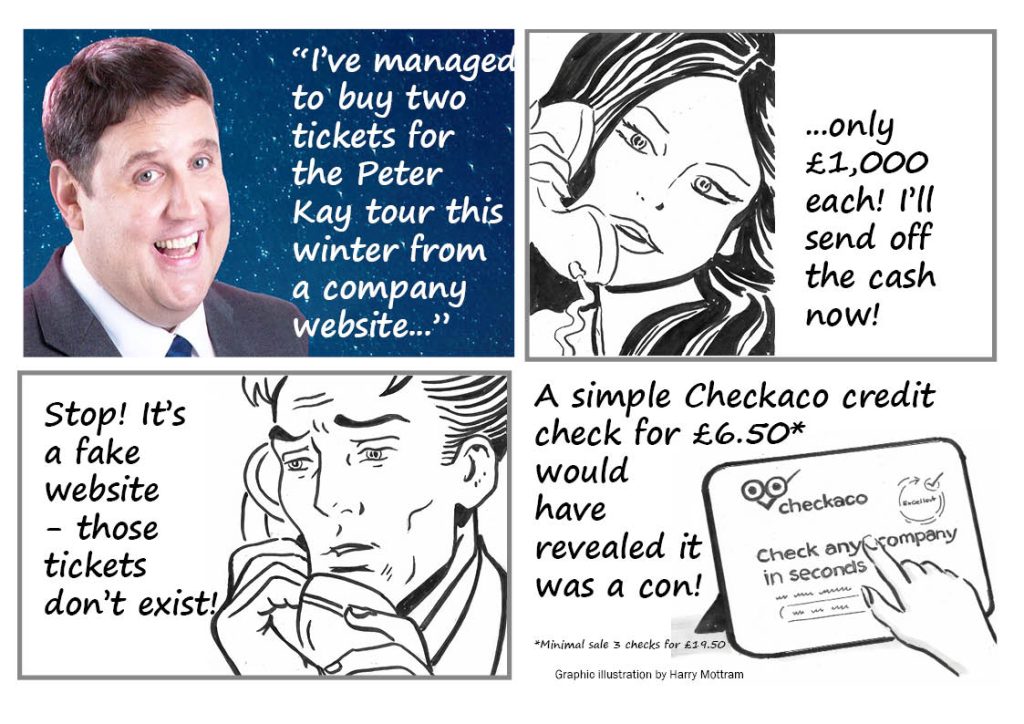

Checkaco Consumer News: concerns of Viagogo ‘marking up Peter Kay tickets 1,080%’ plus warnings over fake ticket sites scamming punters

Posted on by Harry Mottram Edit”Checkaco Consumer News: concerns of Viagogo ‘marking up Peter Kay tickets 1,080%’ plus warnings over fake ticket sites scamming punters”

The Bolton-based stand-up comedian Peter Kay has unwittingly sparked a deluge of problems for his fans after announcing a number of live gigs later this year and in 2023. Nothing unusual about that except in this digital age scammers and rip-off merchants are two a penny as they fleece punters of their hard-earned cash.

Ten years ago, when Peter Kay last toured the issue of tickets was more to do with demand from the venue – but now criminals have set up lookalike websites and posing as the legitimate seller. And some unscrupulous sellers as highlighted by Elizabeth Haigh of the Daily Mail have hiked prices for Kay’s shows by 1,080%. She reported: “Tickets at a face value price of £150 each in Leeds in September are now on sale at Viagogo for £1,770 – a 1,080 percent mark-up.”

Clearly people are upset by the huge mark-ups but even worse are fake websites that copy legitimate ones down to last piece of graphic in order to take cash for tickets which don’t exist. The BBC’s Simon Read reported in the summer on scammers selling fake Premier League tickets. He wrote: “Fraudsters are using social media to offer fake tickets and trick unsuspecting victims out of their cash – the average loss is £410, according to Lloyds Bank. The fans pay by bank transfer, which offers no protection to consumers. If you can’t pay by credit or debit card, ‘that’s a big red flag that you’re about to get scammed,’ the bank warned. Cases of the scams climbed by more than two-thirds between January and June, according to Lloyds Bank data. This surge was because fraudsters took advantage of people desperate to attend live events after Covid restrictions ended.”

Using sites on social media such as Facebook, Twitter, Instagram and TikTok scammers list tickets they have – sometimes at low prices claiming to be a fan who cannot make a gig – sometimes at high prices for the most popular events. They will post images of tickets online, but these are usually fakes – and they always ask for payment by bank transfer and use high pressure tactics to clinch a sale suggesting there’s only seconds before the offer is withdrawn. And once the bank transfer has gone through the scammer disappears and you have lost your cash and have no ticket.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++

Checkaco Consumer News: cryptocurrency is a ‘Ponzi scheme’ argument strengthens as FTX almost collapses

By Harry Mottram: Checkaco have reacted to the near collapse of the cryptocurrency giant FTX pouring scorn on the notion that it is the future of money.

The credit checking firm said the digital assets market had been stunned by the demise of FTX when a bail out with Binance saw a draining of support. Around £5.2 billion pounds of withdrawals were made after FTX announced the deal with Binance.

The BBC reported that: “Binance says it agreed to buy FTX’s non-US unit, pending due diligence. FTX’s founder Sam Bankman-Fried and Binance’s chief executive Changpeng ‘CZ’ Zhao are two of the most powerful people in the cryptocurrency market and high-profile rivals.”

They said there were many people who saw the unregulated world of cryptocurrency as being little more than a Ponzi scheme – a view he could understand. Checkaco said: “Whatever you think about sterling, the US dollar and the Euro, those currencies are regulated and are real hard cash or paper money if you want to withdraw your funds – all backed by Governments making them sound.”

Checkaco reminded consumers that seeing huge increases in the value of cryptocurrencies as an investment shouldn’t be seen as a guarantee of riches as the values fluctuate by huge margins. All the main cryptocurrency values have fallen dramatically in the last 12 months.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++

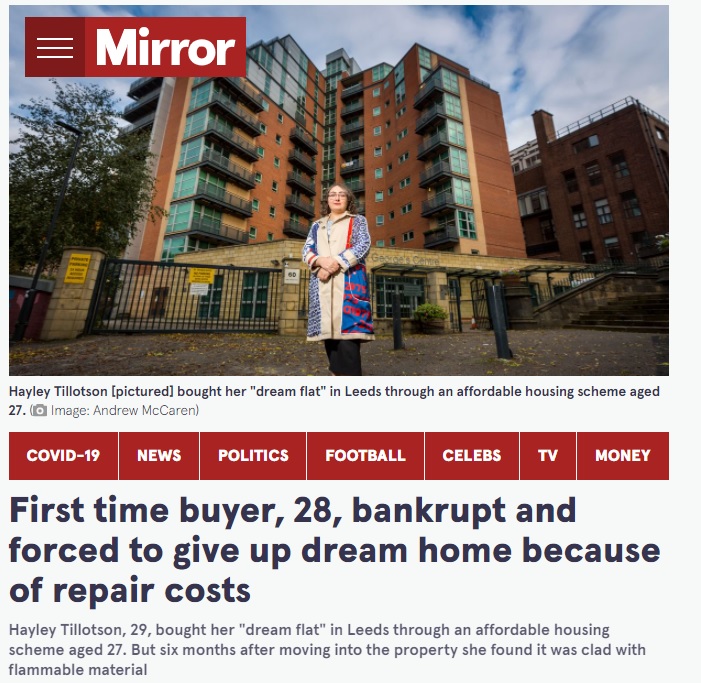

Checkaco Consumer News: Customers left high and dry after major online retailed goes bust

Posted on by Harry Mottram Edit”Checkaco Consumer News: Customers left high and dry after major online retailed goes bust”

Checkaco has hit out at the online retailer Made.com who have gone into administration leaving hundreds out of work and customers in the dark about their cash and refunds.

The administrators PWC said around 4000 jobs would go immediately with another 100 or so once the business had been wound up. However, consumers are left high and dry as there are around 12,000 UK orders unfulfilled with many having paid up front for their furniture from the online retailer.

Checkaco said it was a scandal that tens of thousands of pounds worth of orders may never be refunded – and urged consumers always to check firms with their online checking facility to spot if a company is in trouble before parting with cash.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++

Checkaco Consumer News: latest online scams to watch out for, the bogus training firm highlighted on Rip Off Britain and the builder who went bust taking their customers’ cash with them

Always do a Checkaco on a firm you intend to pay cash to

Everyday emails pop up in junk and spam folders in most people’s computers however some get through the filters and arrive in your in box. Like the one apparently from McAfee Security landing you with a £1,247 pound annual subscription complete with a helpful phone number and email to click on to pay.

McAfee helpfully list all their genuine email addresses on their website – none of which are from the ones demanding hefty fees to protect your computer or laptop. Never click on the links from these fake emails as they are after one thing: your bank details and your money.

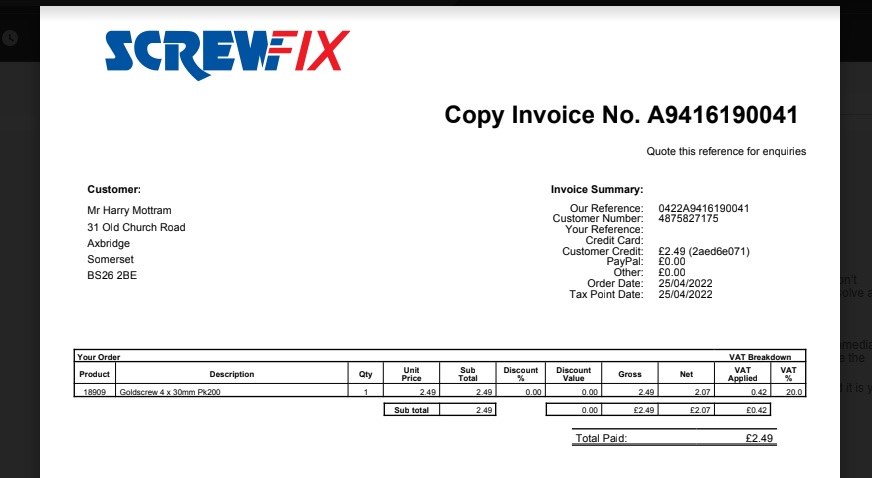

Screwfix scam

Another one doing the rounds is the ones from Screwfix – or so they appear. All the details appear to be genuine except for the most important part – the email address is not from Screwfix. The con being pulled by the fraudsters is more subtle as the amount requested in the fake invoice is only a few pounds. The idea is by sending out millions of these emails someone may assume it is genuine having visited a Screwfix store recently and are expecting a bill. Delete the invoice immediately.

Dodgy builders

Checkaco exists to help consumers in avoiding being ripped off by a limited company. The classic one is when you may be planning on having an extension built on your home. It’s a project that can cost tens of thousands of pounds and the last thing you want is for your builder to start work having been paid up front – only to go bust or do a runner with the money. It happens regularly with the rogues in the business so always do a credit check with Checkaco. Unlike Alan Street and partner Joanne Hart who paid £44,000 to a company called Hudson Garden Rooms who took the cash and then folded the firm leaving them empty handed.

Hudson Garden Rooms, run by couple Chris and Sophie Escrader, went into liquidation with debts of £400,000 in 2019 – but restarted the business as Hudson Living soon after to avoid paying debts or completing the work of their previous clients. It’s a common enough practice but a simple credit check with Checkaco would have spotted they were dodgy.

HGV training fraud

The BBC programme Rip Off Britain has exposed a bogus company that was charging customers thousands of pounds to train to be HGV drivers. It was all a scam as once they paid up front for their lessons, they heard no more from New Wave Driving School in Harrow owned by 39-year-old Usman Qureshi. He was eventually charged, tried and convicted under the Unfair Trading Regulations Act but not before cheating customers of tens of thousands of pounds – which was not returned.

It’s another case of where checking out a company with Checkaco can save you your life savings and sleepless nights of worry and stress.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++++

Checkaco Consumer News: music fans lose their cash after Festicket goes bust leaving them ticketless for a string of gigs and festival dates

Posted on by Harry Mottram Edit”Checkaco Consumer News: music fans lose their cash after Festicket goes bust leaving them ticketless for a string of gigs and festival dates”

Hundreds of music fans have been left high and dry after end-to-end festival experience and ticket supplier Festicket entered administration after a moratorium filed in August ended.

Customers of the firm set up by Zack Sabban and Jonathan Younes in 2014 are unlikely to see any of their cash for a huge variety of ticketed events such as the indoor electronic all-nighter Westfest in October. Also affected is the Secret Project Festival Amsterdam plus Time Warp in Germany, and Evanescence in Lisbon in December along with dozens more events and concerts around the world the firm sold tickets for.

One customer who had planned to go to the Westfest at Shepton Mallet’s Bath and West Showground wrote on her Face Book page: “I bought 4 tickets for Westfest on a payment plan from Festiticket who have just gone into administration. There is no way to contact them… So far they’ve taken £80 so I’ve lost my money and my tickets. Does anyone have any ideas on what I can do? Tickets are now £55 and I can’t afford to replace all 4.”

Others complained that they had paid but could not download their tickets and so had lost their money with no one from Festicket replying to emails. More alarming still is a string of complaints online made by angry customers dating back months at the poor service and failure to send ticket downloads for a variety of festivals. Even in May and June money was not being refunded suggesting major problems with the business. With one distraught customer warning back in the spring: “Don’t buy your tickets from Festicket ever.”

Checkaco advises the public to do a check out companies through their website before parting with cash – the search will quickly show up any financial concerns like County Court Judgements which are red flags for any business.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++++++

CHECKACO CONSUMER NEWS: Andrew Bailey and the FCA are in the firing line as the BBC’s Panorama exposes its inaction over the collapsed Blackmore Bond fund losing the public their life savings

Posted on by Harry Mottram Edit”CHECKACO CONSUMER NEWS: Andrew Bailey and the FCA are in the firing line as the BBC’s Panorama exposes its inaction over the collapsed Blackmore Bond fund losing the public their life savings”

Journalists on the BBC programme Panorama have revealed a shocking level of inaction by the Financial Conduct Authority (FCA) who failed to intervene when the Blackmore Bond fund collapsed.

The fund was controlled by CEO Phillip Nunn, who set up the investment scheme with Patrick McCreesh in 2016 to sell high-risk mini bonds to the general public. Around 2,000 invested in the fund but in 2020 alarm bells rang when Blackmore failed to pay interest to the investors. Having failed to register its accounts with Companies House in 2018 there were growing concerns about how the £25 million invested by the public was being handled.

When the fund collapsed in 2020 the public lost £46 million although concerns were raised with the watchdog FCA repeatedly in 2017 and 2018 over their sales tactics and inappropriate payments. The fund was supposed to be only invested in by experienced operators in the industry and not by the public as it was a high-risk investment offering 10% returns on money put in. Now the FCA and its then boss the current head of the Bank of England Andrew Bailey are in the firing line for their failure to prevent the scandal from unfolding.

Following a BBC Panorama documentary on the collapse of the fund MPs and the Treasury Select Committee in Parliament are demanding an enquiry into the FCS’s failings including those of its CEO Andrew Bailey. Increasingly the revelations give an impression of a Ponzi scheme as explained by Paul Carlier who worked in an office next to the Blackmore Bond HQ. He overheard the illegal sales tactics as they conned members of the public into investing their savings in the fund.

He told the BBC: “[The sales people] were literally cold-calling people and approaching people with an intent to sell them a toxic or worthless investment product, including the Blackmore Bond.”

Checkaco’s advice is that if someone phones or emails you with an offer that sounds too good to be true then it probably is. Ponzi schemes offer high returns on investments but when investors want to withdraw their cash or to be paid their interest excuses are given why they can’t until eventually enough people cotton on there is something amiss. Usually journalists expose the scandal and the fund collapses – and the regulators who have failed to act are also in the dock.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++

CONSUMER NEWS FROM CHECKACO: bride-to-be loses £20,000 put aside for her wedding to ‘double bluff’ bank scam

Posted on by Harry Mottram Edit”CONSUMER NEWS FROM CHECKACO: bride to be loses £20,000 put aside for her wedding to ‘double bluff’ bank scam”

Bank scam warning

She was young, clued up and knew all about phone scams but she still got ripped off in a ‘double bluff’ scam. That’s a scam where the scammer is questioned by the victim who then to prove they are genuine passes them to a so-called official who gives them a crime reference number and helps them by overcome their fears. And it was all set up by an apparent email from Hermes the delivery people.

The Guardian’s Anna Timms has given some advice to a reader who had fallen for the scam and who has not been re-imbursed by her bank. She said in part of her conclusion: “I believe that the bank’s security processes were inadequate in your case, given that it has far more awareness of scammer tactics than the average customer. Despite the fact that the name on the recipient account did not match the name you thought you were paying, and that the transactions in and out of your account were highly unusual, it did not attempt to block them and question you further.”

The reader said: “It began with two texts, purportedly from Hermes and six days apart, requiring two £1.50 admin fees to reschedule two missed deliveries. Since I was expecting a Hermes delivery of a sofa, I wasn’t suspicious, and I used the link to pay the two fees with my Revolut and Nationwide debit cards.

“Three days later I was called by an agent claiming to be from Revolut, who told me my account had been compromised by a phishing attack. I was then contacted by a caller who said they were from Nationwide. I checked the phone number on Google and it appeared to be genuine. I was told I was being transferred to the “national fraud agency” and given a case number. Eventually, with plausible explanations, they persuaded me to move £20,000 from my Nationwide to my Revolut account, and then to another newly opened account in my name.

“Several generic scam alerts did pop up on the Revolut app, but the caller reassured me it was because it was a new account. At this point I was crying, but I was so caught up in trying to escape the first phishing scam and the belief that they were helping me that I did what they said. By the time I realised I had been scammed, the money was gone.”

A number of cases have now come to light involving victims with Revolut bank accounts. The Mirror reported on 26-year-old Alina Portnova who fell for the same con this time with fraudsters telling her to move cash from her Barclays account acter crooks had tried to access it. Once the £5,672 was moved the fake bank officials asked her to move the cash into a safe holding account and from there they moved the money to their own bank – where ever that is.

Other cases include customers with HSBC and Lloyds bank accounts and the victims tend to be young women. In some cases, Revolut have repaid the stolen money but none for the case that Anna Timms investigated.

That’s because they haven’t signed up to the bank voluntary scheme, called the Contingent Reimbursement Model (CRM), that require signatory banks to detect and prevent payment scams and to compensate the soaring numbers of fraud victims who have not been unduly negligent. Clearly something is wrong here – with the advice being never accept a phone call from a bank claiming your account has been compromised until you get definitive proof it is genuine.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++++++++++

Checkaco Consumer News: after England women footballers beat Germany in the Euros a high street bank warns fans are being scammed by fraudsters over fake tickets

Posted on by Harry Mottram Edit”Checkaco Consumer News: after England women footballers beat Germany in the Euros a high street bank warns fans are being scammed by fraudsters over fake tickets”

By Harry Mottram: with the new football season upon us fans are being duped out of an average of £410 a time by fraudsters selling fake tickets online.

Typically, they advertise on social media so called spare tickets or unwanted season tickets to any of the major football clubs in the Championship and Premier League. All the main social media sites are used by criminals who give authentic sounding reasons why they have the tickets. Alternatively, they set up websites that look very similar to the official club websites so as to fool visitors into buying from them.

Lloyds Bank has conducted research and have discovered that the reported cases of ticket scams relating to football increased by more than two-thirds, or 68%, between January and June this year, compared to July to December 2021. The bank has made the analysis by studying their customers’ purchases and noting when they complained about being scammed.

Sky News reported Lloyds said fraudsters have exploited the demand of people wanting to attend live events after the coronavirus pandemic and added it has seen an increase in purchase scams targeting concert tickets as well as sporting events.

Liz Ziegler, retail fraud and financial crime director at Lloyds Bank, said: “It’s easy to let our emotions get the better of us when following our favourite team.

“But, while that passion makes for a great atmosphere in grounds across the country, when it comes to buying tickets for a match, it’s important not to get carried away in the excitement.

“The vast majority of these scams start on social media, where it’s all too easy for fraudsters to use fake profiles and advertise items that simply don’t exist.

“These criminals are ready to disappear as soon as they have their hands on your money.

“Buying directly from the clubs or their official ticket partners is the only way to guarantee you’re paying for a real ticket.”

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++++++

CHECKACO NEWS: BBC’s Countryfile presenter Helen Skelton is scammed out of her £70K life savings

Posted on by Harry Mottram Edit”CHECKACO NEWS: BBC’s Countryfile presenter Helen Skelton is scammed out of her £70K life savings”

One of the best known faces on BBCTV admits to being ‘stupid’ in falling for a ‘dodgy’ phone call that emptied her bank account.

Helen Skelton, best known for presenting Countryfile on television but also famous for being one of the presenters of Blue Peter for years, admitted falling for the scam was a big mistake. She said: “I got phoned up by the bank, told something dodgy had been going on with my account. A week later £70,000 had gone.”

The fraudster said that someone had tried to get into her bank account and convinced to her to give details so they could move her cash to a safe account. When she checked back she discovered the money had disappeared – stolen in fact from her account as it was nothing to do with the bank.

Helen said: “I cried buckets when I realised. That money was meant to be for my children’s future. I was thinking of my kids, and about how I would have to work even more and not see them to try to get it back.”

How to protect yourself from phone call scams

Keeping ahead of the scammers may seem like an impossible task, but Age UK has a number of tips that can help keep you safe if you receive an unwelcome call.

1. Don’t reveal personal details. This includes any bank details or your pin number.

2. Hang up. If you’re feeling threatened or think someone is being aggressive, put down the phone.

3. Ring the organisation. If the person is who they say they are you can always ring the company or bank and check.

4. Don’t be hurried. Experienced scammers will try and get you to do things quickly by talking about a time-limited offer.

Source: Age UK

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++++++

CHECKACO NEWS UPDATE: Countdown to the end of funeral plan fraud on 29th July: regulator names firms YOU SHOULD NOT buy plans from (and lists ones they’ve approved of)

Posted on by Harry Mottram Edit”CHECKACO NEWS UPDATE: Countdown to funeral plan robbery: regulator names firms YOU SHOULD NOT buy plans from”

Following the scandal of the collapsed Safe Hands funeral plan company the Government’s Financial Conduct Authority (FCA) have published the names of two firms to avoid.

The warning comes ahead of the deadline when all firms in the lucrative sector must be regulated by law. Any that fail to be registered will be banned from trading – but until July 29th, 2022, when the regulations start anyone can offer the public funeral plans.

The FCA name Empathy Funeral Plans UK Limited and Unique Funeral Plans as two firms to steer clear of. They said: “We have been clear for some time that people should avoid buying new plans from funeral plan providers that have not applied for authorisation or had their application withdrawn or refused. We are repeating this guidance and strongly advise that you do not buy a plan from Empathy (Empathy Funeral Plans UK Limited) or Unique (Fox Milton & Co Limited, trading as Unique Funeral Plans).

There are nearly two million people who have taken out pre-paid funeral plans with some 65 companies paying on average around £4,000 each in the UK with an estimated 200,000 new plans sold every year. It’s a growing market but without regulation (declined by David Cameron’s Government in 2000) it has become something of a free for all since anyone can set up a company offering so-called peace of mind plans.

From 29 July, all funeral plan providers will need to follow new FCA rules, which include a ban on cold calling and commission paid to intermediaries, and high standards on governance and financial resilience. Funeral plan holders will be able to refer complaints about a firm to the Ombudsman and will be covered by the FSCS if their provider goes out of business.

Emily Shepperd, Executive Director of Authorisations at the FCA, said: “As this sector approaches regulation, we want to provide holders of pre-paid funeral plans with some reassurance, which is why we have published a list of the firms we intend to authorise.

“Our regulation will lead to higher standards in the market and boost consumer protection. We want to see an improvement in the way customers are treated, with better value products, better sales practices and better controls in place so consumers can be confident they will receive the funeral they expect.”

The FCA are still looking at a small number of firms but in the meantime have published a list of companies that will abide by the rules from the 29th of July:

Alternative Planning Company Limited

Avalon (Europe) Limited

Avalon Trustee Company Limited

Celebration Of Life Planning Ltd

Central England Co-Operative Limited

Co-Op Funeral Plans Limited

Crystal Cremations Ltd

Dignity Funerals Limited

Distinct Funeral Plans Limited

Ecclesiastical Planning Services Limited

F A Albin & Sons Limited

Family Funerals Trust Limited

Freeman Brothers (this includes Peter Christopher Freeman and Bridgid Mary Freeman)

Golden Charter Limited

Golden Leaves Limited

Haven Personal Funeral Plans Ltd

Independent Funeral Planning Services Ltd

Low Cost Funeral Limited T/A Affordable Funerals (this includes Memoria Limited)

Peace Burials Limited

Plan With Grace Limited

Pure Cremation Planning Ltd

Southern Co-Operative Funerals Limited

The Independent Family Funeral Directors Ltd (this includes Fosters Family Funeral Directors)

William Alty & Sons Limited

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++

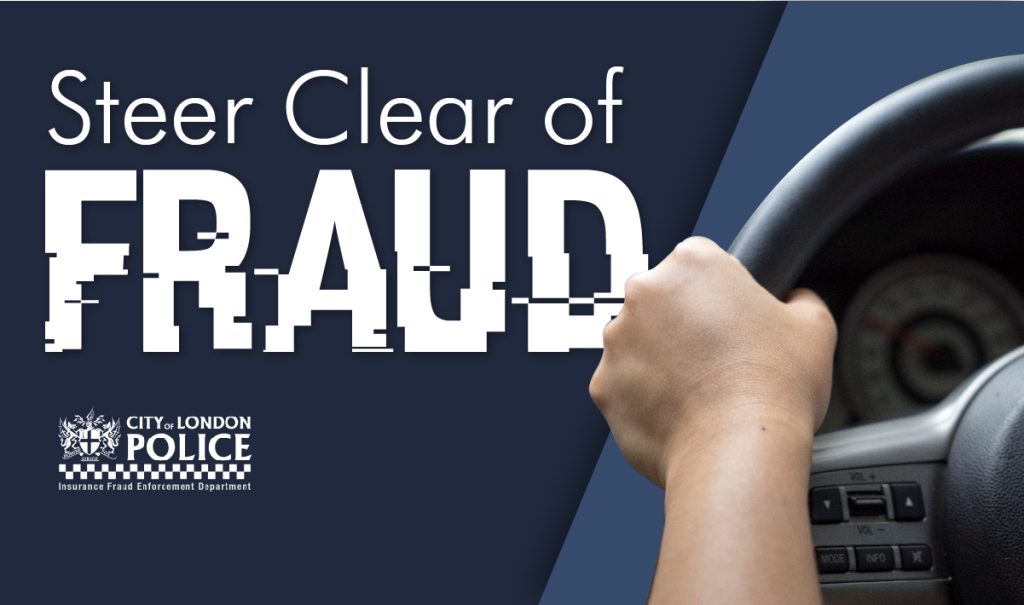

CHECKACO NEWS: car insurance scam targeting young drivers with fake insurance

Young and vulnerable motorists are being sold cheap fake car insurance by fraudsters on an industrial scale through social media.

Victims typically see an advert for car insurance considerably lower than £2,000 for a typical Ford Fiesta from a reputable insurance company and ask for a quote from a fraudster posing as a broker.

The broker uses forged paperwork from a well-known company and gives the victim a huge discount which they sign up to and pay their premium in one payment.

It is only when the new driver is stopped by the police or are involved in an accident that they realise they don’t have any insurance.

Action Fraud said that thousands of people fall for the scam each year losing all of their cash as it is often weeks or months before they realise, they’ve been had. IFB Insurers believe 21,000 such policies have been linked to the scam while there are almost many more people driving around today ignorant of the fact their so-called insurance are worthless.

How to avoid ghost brokers

If a deal seems too good to be true, then it probably is.

Ghost brokers often advertise on student websites or money-saving

forums, university notice boards and marketplace websites such as Gumtree. They may also try to sell insurance policies to you through adverts in pubs, clubs or bars, newsagents and car repair shops.

Be wary of brokers using only mobile phone or email as a way of contact. Ghost brokers have even been

reported using messaging apps, including WhatsApp, Snapchat and Facebook. Fraudsters don’t want to be

traced after they’ve taken money from their victims.

If you are not sure about the broker, check on the Financial Conduct Authority or the British Insurance Brokers’ Association website for a list of all authorised insurance brokers: register.fca.org.uk and biba.org.uk

You can also contact the insurance company directly to verify the broker’s details.

You can check to see if your car is legitimately insured on the Motor Insurance Database website: ownvehicle.askmid.com

If you think that you’ve been a victim of a ghost broker, you can report your concerns to Action Fraud at actionfraud.police.uk or on 0300 123 2040.

You can also contact the Insurance Fraud Bureau via its confidential Cheatline on 0800 422 0421 or at insurancefraudbureau.org

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++++

CHECKACO NEWS: As crypto currencies crash fears are raised that some are in effect Ponzi Schemes as industry is defended on TV

Last November the Bitcoin was on a high as the new crypto currencies appeared to enjoy financial stability suggesting they were a new way to get rich by investing in them.

Eight months later and Bitcoin has halved in value, Celsius Network has frozen withdrawals, TerraUSD is now valueless, while Ethereum one of the big currencies in the field has plunged in value.

Investors in some currencies have potentially lost their entire investment while others have seen what they put in devalue to almost worthless amounts.

The advice from Checkaco has and always will be don’t invest in any scheme unless you can afford to lose everything. Many commentators have likened cryptocurrencies to Ponzi Schemes in that they suck in huge amounts of money only for the bubble to burst. They criticise the advocates of the currencies as the sector is unregulated and is not based on anything tangible like property, oil, gold etc.

Bitcoin is still the largest of the crypto currencies with a crowded market of similar types, number around 19,000 with some worthless and others claiming to be increasing in value. The cause of the collapse in value of many of these currencies has been the bear market in the traditional stock markets triggered in part by the Ukraine war. Those declines though are tiny compared to wild volatility of the virtual ones so the message is if you want stability stick with the tried and tested and indeed regulated.

Michael Saylor, the CEO of MicroStrategy didn’t help matters when challenged this week on CNN by Julia Chatterley by attempting to liken the creation of cryptocurrencies to the invention of the motor car and admitted ‘average investors’ had been taken advantage of. Writing for the Guardian Professor Robert Reich likened the currencies to Ponzi Schemes where the people who start them become rich while the newest investors at the bottom are most likely to lose out.

He said: “Before the crypto crash, the value of cryptocurrencies had kept rising by attracting an ever-growing number of investors and some big Wall Street money, along with celebrity endorsements. But, again, all Ponzi schemes topple eventually. And it looks like crypto is now toppling.”

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++

CHECKACO NEWS: New Amazon delivery scam highlighted by TV’s Martin Lewis

Posted on by Harry MottramEdit”CHECKACO NEWS: New Amazon delivery scam highlighted by TV’s Martin Lewis”

Scam alert

The Money Saving expert Martin Lewis has issued a warning over a ‘clever’ scam pretending to be from the Post Office about an Amazon delivery.

He said: “Beware. Just had a clever version of the ‘pay £1.99 for Post Office Parcel delivery’ scam text, aiming to steal bank info. The ‘fee’ isn’t mentioned in the text, it talks about “delays in transit” and offers “a date to reschedule”. It’s only when you click thru it mentions a fee.”

Checkaco have said that anyone receiving the message should forward it to 7726 for it to be investigated by Ofcom as the main aim is to drain the victim’s bank account. There is no delivery simply a criminal attempt to steal cash.

Checkaco have urged the Government to invest in catching the criminals behind this and other scams by increasing Action Fraud’s resources.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++++

CHECKACO NEWS WARNING: Scammers tricking people to enter false Father’s Day beer competition

The makers of the lager beer Heinekin have appealed to the public not to enter a competition circulating on the internet as it is a scam.

Ahead of Father’s Day on Sunday, 19th June, a message has been appearing on WhatsApp offering the chance to win one of 5,000 coolers full of lager and links to a fake quiz-style competition.

The brewing company with its headquarters in Edinburgh and sites in England said it was a phishing scam set up by fraudsters to trick people into giving their bank details. The criminals behind the con then drain the bank accounts of the victims before they are aware they have been fooled.

It is a particularly nasty scam as it preys on the goodwill of the offspring of fathers who hope to win a big prize for the patriarchal figures.

Heinekin said anyone receiving the message should “delete it immediately”.

Heineken’s representative added: “We’re aware of the current phishing scam circulating through social networks, which is not sanctioned by Heineken. We have alerted the relevant authorities.”

Action Fraud – the police unit dedicated to catching fraudsters – said that if you receive a random text or WhatsApp message from a brand that you discover is fraudulent, open up the WhatsApp chat from the unknown number, open the sender’s contact details and select Block and Report. Suspicious text messages could be reported to 7726, a free spam reporting service, as well as to the company the text was claiming to be from.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++++++++

CHECKACO NEWS: Tear gas, pepper spray and being hit by a Gendarme’s truncheon – all caused by scam match tickets (here is how to avoid them)

Scam match tickets

Liverpool fans caught up in Paris nightmare for the European Champion League’s match in May were flooded with fake tickets which caused a night of misery.

Thousands of fan bought what they believed were genuine paper tickets which were forgeries meaning when they arrived at the turnstiles their ticket was rejected and they were barred from entry.

Other fans who had genuine tickets were also rejected as someone with an identical copy of their ticket had gained entry before them leaving their ticket invalid.

It meant thousands of fans could not gain access to the ground as the entry system descended into chaos – not helped by the ground which kept some of the entries closes, ticketless local youths climbing the barriers and causing trouble outside, a police force who over-reacted and pepper sprayed innocent fans waiting to enter and the organisers UEFA who failed to learn from previous problems. And the stadium authorities clearly were caught out by the event and failed to get themselves organised.

Official tickets could only be purchased from UEFA.com who released 52,000 tickets for fans and the general public from a total of 75,000. Both Madrid and Liverpool clubs were issued with 20,000 tickets for their fan base of which 10,000 were free to those who suffered during the covid pandemic while a further 12,000 tickets were sold to a global audience of fans football. Liverpool and Madrid were charged with distributing and selling their allocations. The tickets ranged in price from €70 to €690. It should have been a straight forward operation to access the stadium as the tickets were delivered via the official UEFA Mobile Tickets app from ten days before the match.

However, criminals had bought official tickets and then reproduced them on an industrial scale selling them via social media to fans who were not aware they were fakes. The advice is not to buy from anyone other than the club or from UEFA and don’t get fooled by so called ‘official’ organisations based abroad or from an address not associated with the clubs or UEFA – and never direct transfer cash to the seller.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++++++++

CHECKACO NEWS: Customers risk losing their cash by placing orders with a troubled online fashion store that is teetering on the brink of collapse

Online fashion house Missguided is still taking orders on their website despite fears the business is about to fail meaning their money may not be refunded.

Checkaco has said anyone planning on ordering from the business should understand the risks after suppliers to Missguided turned up at the headquarters of online fashion company demanding to be paid. They have now filed a compulsory liquidation with a petition lodged against the firm in the high court in Manchester. If that goes through then the company with be liquidated and any money made from the sale of the stock will go to paying bills such as VAT and the taxman as well as trade suppliers and staff. Customers may well lose out.

With a partnership with the TV reality shoe Love Island it was thought the company would be highly profitable but the rag trade is notoriously competitive with very slim margins.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++++++

CHECKACO NEWS: Young fundraisers could lose all their cash as sustainable development charity Raleigh International goes bust

Posted on by Harry Mottram

Young fundraisers could lose all their cash as sustainable development charity Raleigh International goes bust

A charity launched by Prince Charles in 1978 has gone bust leaving up to 50 staff out of work and hundreds of young people in the lurch with their hard earned cash from fun raising lost.

Raleigh International is a so-called sustainable development charity linked the Royal Family and is seen by critics as the charity for the well-heeled who want to do their bit for the poor around the world. Both Prince William and Kate Middleton have taken part in the scheme in previous years. Young people sign up and pledge to raised thousands of pounds to pay for their travel and accommodation in countries in Africa, Asia and South America where they will spend several weeks helping on projects to help struggling communities. Some 55,000 people have used the charity to help others around the globe with projects from building community buildings, digging wells and introducing innovative farming methods to remote villages.

Last week the charity suddenly announced they were ceased operations and entered Creditors’ Voluntary Liquidation having appointed Carter Backer Winter as liquidators.

In a statement they said: “It is with enormous sadness that we report Raleigh International Trust will cease operating from Thursday 19 May 2022. Raleigh International Trust is inclusive of Raleigh Nepal and Raleigh Nicaragua. Raleigh Tanzania and Raleigh Costa Rica have independent status, and we are currently exploring the future viability of them operating without Raleigh International Trust.”

The charity blamed the effects of Covid cancelling a number of projects and trips and the reduction in overseas aid from Governments.

However, that is cold comfort for the hundreds of young people who have already raised tens of thousands of pounds ahead of their trips having sent their cash to the charity. All of that cash could now be lost.

The Times reported a typical case of a volunteer losing out. They quoted Rosie Giesler, 20, from Cambridge, who was due to fly to Costa Rica at the end of July for a ten-week sustainable development programme. She had raised £3,800 by the fundraising deadline on May 16, three days before the announcement. Another victim they reported on was Will Chubb who is only 17 and had raised £2,300 for the charity having also paid for vaccinations, flights and a visa for Nepal ahead of his now cancelled trip.

His mother was furious with the charity as they must have known things were about to collapse but still accepted cash from the volunteers. The Charity Commission said they were looking into the case and were in talks with the administrators.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++

CHECKACO NEWS UPDATE: Don’t send off valuables in a box to companies advertising on TV claiming to help you declutter

It seems such a simple idea: scoop up all your unwanted nick-nacks into a pre-paid box and send them off to a firm advertising on the TV who will send you a generous amount of cash. You know they may sell the items for more, but they are off your hands and no longer gather dust.

If a typical box contains an old video camera, some rings and necklaces, a vase or two and some old toys from your childhood you’d probably be happy with a hundred pounds or more. Think again. Scores of complaints have been lodged on-line against firms that offer this service and the theme is that £30 is the top price they pay for any box and if customers reject the offer the box is returned with items missing. A war of denials results with the potential customer out of pocket and out of their once unwanted clutter.

Checking out the forums and social media sites is depressing as so many people appear to have been stung. They complain of being offered only a few pounds for their goods and struggle to get them back in tack if they refuse the minimal offer. On TV the adverts imply the companies are keen to help you declutter by offering a service to relieve you of unwanted clutter but all they do is rip you off according to the reviews.

A quick Checkaco credit check on any of these companies quickly reveals they may not all be that they seem with the sad news they often have CCJs and a poor credit history.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++++

CHECKACO NEWS UPDATE: The high risk of paying into a funeral plan – ahead of enforced regulation Safe Hands goes bust losing all the money their 46,000 customers invested in funeral plans

Reports that directors of failed funeral firm Safe Hands ‘helped themselves’ to £60 million trust money ahead of regulation being imposed has set alarm bells ringing in the industry.

On July 29, 2022, firms who offer pre-paid funeral plans will be regulated by the Government’s Financial Conduct Authority (FCA). Those firms which decline to be regulated must cease trading. Ahead of the deadline there are increasing concerns that some companies will deliberately go bust taking with them the cash invested in them by their customers.

The concerns are genuine following the collapse of Safe Hands whose 46,000 customers will almost certainly lose all their money invested at an average of £4,000 a plan. Media reports have revealed a scandal in which the directors of Safe Hands cynically looted the £60 million pounds held in trust by the company paying themselves vast dividends and hiding millions in other investments and luxury lifestyles.

There are nearly two million people who have taken out pre-paid funeral plans with some 65 companies paying on average around £4,000 each in the UK with an estimated 200,000 new plans sold every year. It’s a growing market but without regulation (declined by David Cameron’s Government in 2000) it has become something of a free for all since anyone can set up a company offering so-called peace of mind plans.

Day time TV is saturated by firms offering customers to pay over several years for plans which mean their relatives won’t have to find the money to pay for their funerals. It’s a good idea for those who can afford it but without regulation there is no knowing that their money is safe if the firm goes into administration as promises made as it the case of Safe Hands to ring fence the funds were broken.

Now there is concern over other companies collapsing with their investors cash before July 29. Heavenly Services went bust in February leaving their customers without any cash despite having taken thousands of pounds in payment plans and there are increasing concerns over more of these companies crashing.

Checkaco’s spokes person said there are some tried and tested companies like the Co-op but if you are considering taking out a pre-paid plan then do a Checkaco credit check on them or wait until after July 29.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++

CHECKACO NEWS: check out the builders first if you plan to use them to construct an extension on your home (or you could end up with £100,000 bill like this MP)

Many people have engaged builders to extend their homes after being stuck inside with the Covid lockdowns and a need to work from home and create a professional office space.

Having an extension can increase the value of your home and create more space making it a more attractive place to live – but beware. Engaging a building firm with a dodgy record of work is bad enough but one with financial problems could leave you high and dry financially. Always check out a limited company with Checkaco to find out if they are either going to go bust on you taking your cash with them – or simply disappear with your hefty deposit.

One such case came to prominence this year with the MP for Wyre Forest Mark Garnier explained how building work on his home took five years instead of the six months promised and a bill of £100,000.

The Daily Mail spoke to him about the case. He said: “It started well and the standard of work was OK. But it soon became clear it would take much longer than we’d expected, and the two builders quickly dropped to one when the junior got fed up with his working conditions. When the work was overdue by four months, they had barely finished half the contract. They stopped taking our calls and when we went to visit the project manager’s home, he refused to see us.

“Eventually, the site was completed to a basic level, with no extension and large parts left undone. That’s when the real nightmare started. They presented us with a mostly fictitious six-figure bill. We engaged a legal team to challenge it but, at each turn, the builders made up more charges.”

He said that after five years and sleepless nights they ended up with a legal bill of £100,000.

It just goes to show how things can go wrong if you choose the wrong builder. The main causes of bad builders are either a lack of professionalism or financial issues. Unprofessional builders can be weeded out through recommendations and qualifications, but financial problems are easier to hide. That’s where Checkaco comes in as a quick check with the firm will reveal County Court Judgements (CCJs), struck off notices and a credit history that should make you run for the hills.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++

CHECKACO NEWS: Beware of that invoice that arrives by email – it might be a scam

An email arrives on the family computer for a small amount of money from a DIY store requesting payment. Nothing unusual in that – in a busy life invoices come in for all manner of expenses and it’s always best to pay them promptly. Except this one, writes Harry Mottram.

The invoice in question is from Screwfix for £2.49. It looked genuine enough except I hadn’t ordered or bought anything from the firm nor had anyone else in my household. But I could so easily of paid it thinking I had a memory lapse or that it was such a small amount that it wouldn’t be a problem if a friend or relative had ordered whatever it was under my name and email.

But there was something odd about it so I checked with Screwfix and they said: “We are aware of a fraudulent email sent to both customers and non-customers stating it is an invoice from Screwfix.”

The fraudsters send out hundreds of thousands of emails in the hope that if only one or two percent of those that receive them pay up they will be quids in. But it is a fraud and totally illegal and once they have hooked a victim they will target them with more scams.

Action Fraud of the Police said: “Fake invoice scams happen when fraudsters send an invoice or bill to a company, requesting payment for goods or services. The invoice might say that the due date for the payment has passed, or threaten that non-payment will affect credit rating. In fact, the invoice is fake and is for goods and services that haven’t been ordered or received. If fraud has been committed, report it to Action Fraud.”

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++++

CHECKACO NEWS UPDATE: the £3.2 million that Katie Price’s company owes in tax and to the public who paid for goods

Katie Price’s business is shut down owing millions to suppliers and members of the public who won’t get all of their money back.

Much has been written about the demise of the glamour model Katie Price’s business which as a limited company is a separate entity from her personally. For the record her company Jordan Trading Limited that ceased trading in 2017 owed the taxman £192,376 along with more than £25,000 to suppliers and members of the public. They lost out by ordering goods from her firm for items such as cosmetics and clothing. Liquidators expect them to get as little as eight pence in the pound.

The Sun reported some of the details that her firm owed including the fact she is unlikely to have to fork out £176,621 in tax.

Checkaco’s company checks have flagged up problems in the past for Jordan Trading Limited. The newspaper said: “The firm was put into voluntary liquidation five years ago with the 43-year-old’s total debts now up to £3.2 million and there are fears she may even lose her ‘mucky mansion’.”

A row broke out over the cost charged to the company by the liquidators Moorfields who claimed their fees were high due to the complex nature of winding up the business.

Katie Price tried to raise cash from sales from new lines such as equestrian goods under Dazzle in the Saddle, Scented By Katie Price, a children’s boutique Princess & Bunny and clothing and accessories under the DEPOP name.

The glamour model and celebrity is not the only famous face to use her name to sell to the public only for everything to go wrong with the public losing their money. Actress Lindsay Lohan’s club in Mykonos, Greece, collapsed within weeks of opening, the Kardashian’s promoted a debit card that was pulled within days of its launch due to its high fees, even Steven Spielberg tried his own submarine themed restaurant which failed and of course Donald Trump famously had more business failures than successes in the betting industry. All big names – all who took the public’s cash – so you’ve been warned – always run a Checkaco on a business before parting with large amounts of cash.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++

CHECKACO NEWS UPDATE: the perils of giving credit to firms as a sole trader

If only there had been Checkaco a few years ago when I worked as a graphic designer in the 1990s. During a short period of a few months a number of clients – all limited companies – went bust owing me just short of £20,000.

They all seemed so professional. A magazine publisher, a private school, an estate agent, a mortgage company and a marine insurance outfit. A credit check on them would have revealed a string of County Court Judgements against their names which in anyone’s money is a red warning light.

Initially things went well with all the clients paying within 30 days of the date of my invoice. But after a few months a slippage occurred with me as a one-man business having to send reminders and phone calls to prompt payment. All the classic excuses were made – the cheque is in the post, we haven’t received your invoice, the person who signs them off is away etc.

As the delays got longer I would get increasingly concerned but foolishly continued the work. Soon payment was 60 days and then 90 days causing me to extend an overdraft and eventually to re-mortgage my home when they failed to pay completely. They all went out of business – and even asked me when they had begun new businesses from the same offices under a new name to begin supplying them with design work.

I refused – and had learnt my lesson the hard way. If a company fails to meet your credit terms stop supplying them. Before you even start work for a limited company check them out on Checkaco.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

+++++++++++++++++++++

CHECKACO NEWS: beware of the fake aid websites claiming to raise cash for Ukrainian refugees – we list the ones to avoid and the official ones helping to save lives

Fraudsters are pretending to raise funds for Ukraine by creating websites using the name of the country in the title in an attempt to fool people into donating to them.

Unfortunately, all the money goes to criminals. Look out for these as they are fraudulent: help-for-ukraine.eu, tokenukraine.com, supportukraine.today, and ukrainesolidarity.org.

These and many more have been seen by members of the public with more being created every day to trick people into donating online. The Fundraising Regulator, the Charity Commission for England and Wales, National Trading Standards and Action Fraud have issued guidelines to the public who wish to donate online to the Ukraine refugees.

Data from Action Fraud reveals that £1.6m of the public’s money was lost to online charity fraud over the past year as non-existent charities and the fraudulent collections pretending to be from official charities scooped the cash.

The legitimate and most widely use websites for the Ukraine crisis are these:

Disasters Emergency Committee (DEC)

https://donation.dec.org.uk/ukraine-humanitarian-appeal

Every pound given to the DEC is matched by the government, up to the value of £20m. You can donate at a Post Office, as well as directly. It includes The British Red Cross, Christian Aid, Action Against Hunger, Oxfam, Save the Children and many more mainstream charities.

UNHCR, the UN Refugee Agency

UNHCR has a long-standing presence in the region, including in Poland, Hungary, Moldova, Slovakia and Romania, and is coordinating the refugee response with other UN agencies and NGO partners, in support of national authorities.

The World Health Organisation (WHO)

The WHO Health Emergency Appeal for Ukraine supports vital healthcare to treat patients wounded by the conflict or those in need of vital care.

Médecins Sans Frontières / Doctors Without Borders (MSF)

(MSF) teams are working to deliver emergency medical aid to people still in Ukraine, as well as those now seeking safety in neighbouring countries.

There are more well established charities also support the refugees including ones for the Roman Catholic Church Cafod, World Jewish Relief and the Orthodox Churches. Plus there are local collections and more well-known charities raising cash along with newspapers – but the ones above are the main ones for Ukraine especially the DEC.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

++++++++++++++++

CHECKACO NEWS: VAT fraudster arrested in Spain after nine years on the run

Posted on by Harry MottramEdit”CHECKACO NEWS: VAT fraudster arrested in Spain after nine years on the run”

Sarah Panitzke was arrested in Santa Barbara in Spain while walking her dogs this week. The unremarkable looking 47-year-old woman was one of Britain’s most wanted criminals having skipped the UK after being convicted of a phone tax fraud in 2013.

Born in Spain but brought up in England Panitzke was the bookkeeper and administrator to an 18 strong team of criminals. They bought large numbers of mobile phones abroad and sold them in the UK and elsewhere without paying any VAT or other taxes netting huge profits. When they were busted by the authorities they were estimated to have made £1 billion.

At the trial Panitzke was sentenced to eight years in jail and was ordered to repay £2.4 million to the authorities for her part in the tax fraud.

The National Crime Agency said: “She controlled the company accounts of many companies remotely via different IP addresses. Panitzke travelled extensively to further the fraud to places including Dubai, Spain and Andorra. She was responsible for laundering approximately £1billion.”

The rest of the gang were also convicted at the time and all given lengthy prison sentences and ordered to pay £111 in total as part of their ill gotten gains.

There’s an old saying there are only two certainties in life: death and taxes. The taxman in this case has finally got his woman.

CHECKACO ADVICE: if you knowingly buy a phone that you know has been imported without paying VAT then you are part of the fraud. If you suspect someone is trying to sell you a phone that you think has not paid the relevant tax then you should contact Action Fraud. See https://www.actionfraud.police.uk/

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/

For details about Checkaco email info@checkaco.com or visit the website https://checkaco.com/

Checkaco, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR UK

************************

CHECKACO NEWS: be careful when buying from an unofficial ticket company for football tickets as your cash may not be refunded if the game is postponed – as shown in this case

There was a time when you went a football match and paid a fiver as you went through the turnstile and maybe splashed out on a pie and a Bovril once in the ground.

Tickets for a Liverpool, Manchester City or Arsenal game are between £50 and £80 but if you choose a hospitality package you could spend up to £500 or more meaning it’s cheaper to go to the Royal Opera House in London and watch Tosca performed – knowing what the ending will be.

Buying your ticket from the football club is the safest way to buy – although you may find your chosen deal is sold out months in advance – and nobody seriously expects the likes of Spurs or Manchester United to go bust. However there are umpteen ticket sites run by unofficial companies who offer often cheaper deals from the official club prices. And that’s where problems arise.

Take for instance JM who lives in Germany and paid £890 to Seatsbay.com for three tickets to watch Liverpool play Arsenal in the Premier League this season. The match got postponed and the match was rearranged – but for a date JM couldn’t make. So, JM asked for a refund but was only offered 60% of the price leaving JM £356 out of pocket.

Writing in reply to the consumer in The Guardian, Anna Timms advised: “The law is unambiguous when an event is cancelled. The customer should get a refund. Rescheduling is one of those notorious grey areas. The now defunct Office of Fair Trading ordered football clubs to refund fans in full if they could not attend a rescheduled match. However, those who buy from unofficial resellers have fewer protections.

“Seatsbay says its refund policy is in its terms and conditions. “Refunds will not be issued if the date changes, as we spent time and money getting the tickets,” it says. “This is not something we try to hide, or that is written in small print.” In fact, the relevant clause is a line of small print half-way down the voluminous terms and conditions.

“According to the Competition and Markets Authority (CMA), refund rights depend on the seller’s terms and conditions, but those which exclude a refund in any circumstances are likely to be unfair and unenforceable, while any deductions should be reasonable.”

Many unofficial ticket sellers have extremely unhealthy finances and may well have a chequered history with the authorities. A Checkaco check will spot if they have CCJs against their name or have other tell tale signs they may not be reliable.

Checkaco was created for consumers so that they can quickly access very detailed information about a company. Using our secure search, you can view any company anonymously in seconds

Full peace of mind for £6.50 per company checked when you buy three reports for £19.50.

Quickly view a company’s CCJ’s, legal ownership, credit history, credit score and more.

Or buy in bulk: 10 reports for £37.50 (£3.75 each); 25 reports for £88.75 (£3.55 each); or 100 reports for £335 (£3.35 each)

Get the low down on any firm at https://checkaco.com/